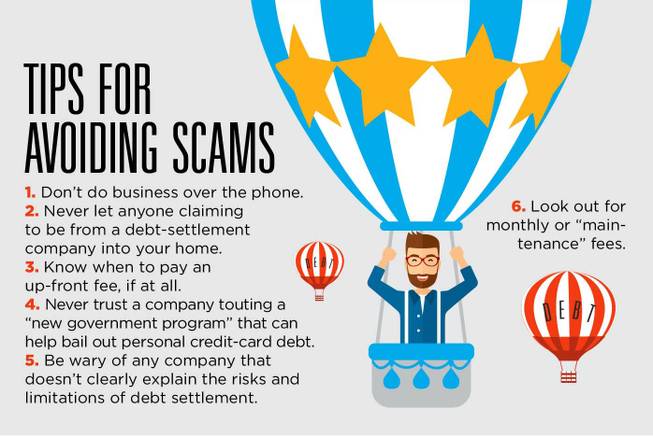

Is Debt Settlement worse than Bankruptcy?

If done correctly, no. It is far better, because you can eliminate your debt for pennies on the dollar and avoid bankruptcy. If done improperly though, debt settlement can be worse than bankruptcy, and even lead to bankruptcy. This is why it is very important to hire a full service debt relief law firm like PandA to handle your debt