In the Aug. 28 edition of The Sunday, we went over the basics of tracking your spending. But understanding your spending is just the first step in creating a simple budget.

I know “budget” is a scary word for some; it involves planning, math and discipline. But what is a budget? At the most basic level, budgeting means planning before doing. That’s it. That’s not too bad, is it?

A nonmonetary example: Most of us commute daily. Whether it takes 15, 30 or 60 minutes to get to a destination, we plan ahead so we get to work on time.

If you have to be at work by 9 a.m. and it takes you 30 minutes to get there, you plan to leave by 8:30 a.m., budgeting yourself 30 minutes to get to the office.

What happens when things don’t go as planned in the morning? Maybe your alarm didn’t go off or you hit the snooze button too many times. Maybe there was an accident that backed up traffic. Maybe all the kids going back to school changed the traffic patterns, or maybe you even have to drop your own kids off.

All of these things mean it’s going to take you longer to get to work. If it’s an unexpected occurrence, like an accident, causing you to be late, there isn’t much you can do about it. But if it’s back-to-school time, you might leave the house a little early to compensate.

The point is that budgets can change and do change. They’re fluid.

This is especially important to remember when you’re building a spending budget. It’s a living thing that’s going to change over time. There’s no reason to be disappointed if your budgeted expenses go up or down; that’s expected when you’re doing this for the first time.

Eventually, your budget will settle down just like your morning routine and commute. There may be bumps in the road, but with planning, even those will be manageable.

The basic budget

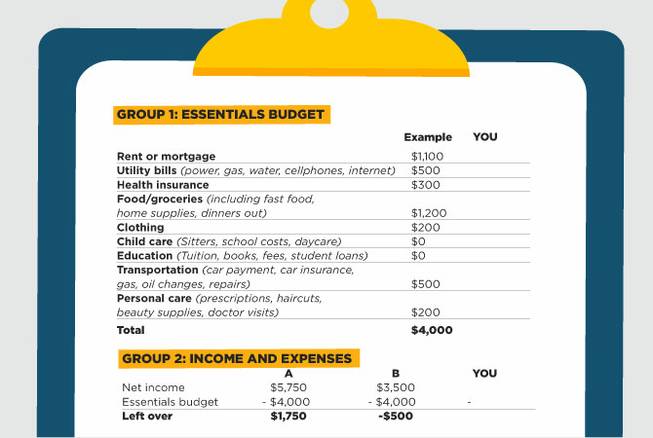

Start to build a simple household budget by asking yourself what types of expenses you have. Group 1 has the typical “essentials” list for most families, but the exact numbers will be different for everyone.

As you can see from the chart, I don’t have cable TV on the “essentials” list. Cable TV isn’t a true utility; it’s entertainment. We’ll talk about nonessential spending in a future issue.

You’ll also see that I don’t have credit cards or things like payday loan payments on the budget. This particular budget doesn’t account for debt.

When you’re setting out to build a budget, it’s important to focus on the most basic things you need to live.

I’m not suggesting you make cuts to any of your spending habits yet, but before we can start adding the extras (like cable or satellite TV), it’s important to know what you need to spend money on every month. You need shelter, electricity, food, etc.

You can use the blank slots I left to fill in the numbers for what your necessities cost based on your tracked spending, or use online tools like Mint or Quicken if you want to work on a computer.

Taking the basic budget from our example, we can see that this household has $4,000 of spending that happens every month just to keep it functioning at a basic level. That means they need to be earning a minimum of $4,000 every month, after taxes, just to live. This budget also shows that they don’t have children or go to school.

Group 1: Essentials Budget

Rent or mortgage: $1,100

Utility bills (power, gas, water, cellphones, internet): $500

Health insurance: $300

Food/groceries (including fast food, home supplies, dinners out): $1,200

Clothing: $200

Child care (Sitters, school costs, daycare): $0

Education (Tuition, books, fees, student loans): $0

Transportation (car payment, car insurance, gas, oil changes, repairs): $500

Personal care (prescriptions, haircuts, beauty supplies, doctor visits): $200

TOTAL: $4,000

GROUP 2: income and expenses

A

Net income: $5,750

Essentials budget: – $4,000

Left over: $1,750

B

Net income: $3,500

Essentials budget: – $4,000

Left over: -$500

Household A has enough money to cover basic expenses and has $1,750 after all the fundamentals are covered. This is called a budget surplus.

Household B does not have enough money to cover the essentials. They’re overspending what they earn by $500 per month. This $500 is called a budget deficit.

Can household B make cuts?

Possibly. Maybe they could save on clothing or food or something else.

Living within a budget isn’t the point of this exercise. This exercise is simply to figure out what your personal planned spending is on a month-to-month basis. Once you know that, you’ve got a basic budget.

According to Gallup, more than two-thirds of Americans don’t budget on a monthly basis. So if you start using this basic budget to plan your monthly spending, you’re well ahead of the game.

How are you doing so far? Is your spending tracked? Do you know how much you spend on essentials every month? Do you have a surplus or a deficit when all you’re doing is covering the basics?