Question: I’m in my 80s and have recently been hit with medical bills that are more than I’m able to pay on a monthly basis. My daughter suggested I take out a reverse mortgage to increase my cash flow. I need the money now and have plenty of equity in my home, but it seems risky. What would a reverse mortgage mean for me?

Answer: Depending on the circumstances, reverse mortgages can be helpful for some seniors, but you’re right — they can be risky. It’s important to understand what you’re getting into before making the leap.

A reverse mortgage is a specific type of home equity loan that is available for people 62 and older. With a reverse mortgage, rather than making monthly payments toward the loan, you’ll receive monthly payments taken from the equity you’ve established.

It’s different from other home equity loans/second mortgages because it doesn’t require monthly payments to the principal and interest. However, you’ll still be required to pay other fees to maintain the house.

There are a couple types of reverse mortgages, but they’re most commonly offered through the Home Equity Conversion Mortgage (HECM) program and are federally insured by the Federal Housing Administration (FHA).

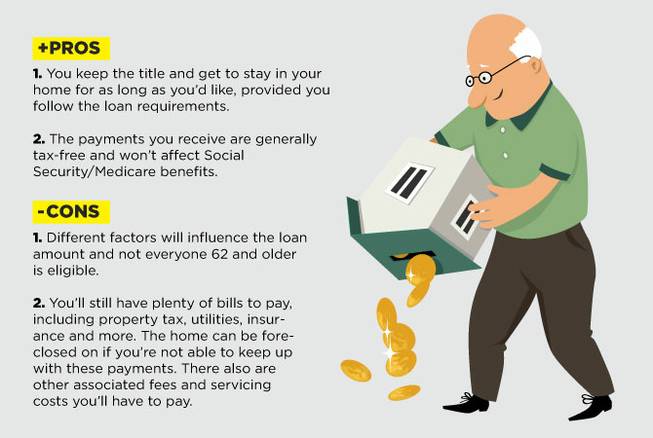

Pros

- You keep the title and get to stay in your home for as long as you’d like, provided you follow the loan requirements.

- The payments you receive are generally tax-free and won’t affect Social Security/Medicare benefits.

- HECMs don’t require the loan be used for any specific purpose, so you can use the money for medical bills, home improvements, groceries or simply to put a little more cash in your pocket.

- You won’t have to repay the loan until you move out, sell the house or die. The loan can be repaid anytime without penalty.

Cons

- Different factors will influence the loan amount and not everyone 62 and older is eligible.

- You’ll still have plenty of bills to pay, including property tax, utilities, insurance and more. The home can be foreclosed on if you’re not able to keep up with these payments. There also are other associated fees and servicing costs you’ll have to pay.

- While you won’t pay interest to the loan anymore, interest will still be added to your balance every month, and it’s not tax deductible.

- Most reverse mortgages are only available at an adjustable interest rate, which means the rate can change without warning and can be costly, depending on how long you hold the loan. Some HECMs allow for a fixed-rate interest, but that requires the loan to be paid as a lump sum rather than in payments or as a line of credit.

- You can’t reverse a reverse mortgage. You’ll have a three-day period after closing to cancel the loan (called right of rescission) but after that, you won’t be able to go back to a traditional mortgage unless you sell the home or repay the loan in full.

Moving, selling or refinancing on a reverse mortgage

Anyone with a reverse mortgage can sell or refinance their home, but those processes can be expensive and tend to be more complex than with a traditional mortgage.

If you need to move or sell … A reverse mortgage requires you to live in your home full time. If you decide to move in with family or to an assisted-care facility, you cannot do so for longer than 12 months unless you sell the house.

When you sell, you’ll need to repay the entire balance of the loan, including interest. After the balance is paid, anything left over from the sale is yours to keep.

Most reverse mortgages have a nonrecourse clause, which means you can’t owe more than the value of the home once it’s sold.

If you want to refinance … There are a few reasons to consider refinancing on a reverse mortgage, such as an increase in principal limits, a drop in interest rates or an increase in your property value. Another reason a person might refinance is to put his or her spouse on the loan. If you’re the only one on the loan and need to move into an assisted-care facility, your spouse will have to sell the house and repay the balance unless he or she is added to the loan.

It’s important to have good counsel if you’re considering a refinance, because the process can be complicated and costly.

What if I die?

Your spouse (if he or she is not on the loan), heirs and/or estate will need to pay back the loan. Usually this means they’ll need to sell the home.

If there’s any equity left after the sale and loan repayment, they’ll be able to keep it — and if the home sells for less than the outstanding balance, they won’t have to pay the difference. However, if they want to keep the house, they must repay what’s owed in full to do so.

°°°

If you have a question you’d like to see answered by an attorney in a future issue, please write to questions@PandALawFirm.com or visit PandaLawFirm.com.