As we head into the holidays, Americans will be inundated with ads proclaiming “no interest for 90 days!” or “no payments until 2018.” Maybe those dates stretch out further, and maybe you’ll even see ads claiming no interest/no payments at all.

The array of marketing offers during the holidays seems endless. At the end of the day, “cheap,” “low” or “no” interest offers aren’t going to save the average person a single penny. And of course, the stores, banks and marketing companies know this.

Introductory rates expire, and offers promising no payments for a given amount of time usually tack on high interest rates quietly. They’re counting on you to buy more than you can afford.

“Never buy anything on credit that you can’t afford to pay cash for.” We’ve all heard it. But there are smart ways to use credit cards.

Earn Money Using Credit

A lot of people think you can use credit to save money and, to a certain extent, that’s true. Zero percent interest on a car, low interest on a house, even a 30 percent discount at department stores — all of these things are credit products people use to save their pennies. But anyone who’s debt-free can use credit to earn money, too.

The simplest version of earning money from using credit is a cash-back card. Cash-back cards usually give 1-2 percent cash-back on every purchase, so if you have one of these cards, simply shifting your spending from cash to credit will earn you money back.

According to the United States Department of Agriculture, the average grocery bill for a family of four is about $833 per month. Using a 2 percent cash-back credit card means you’ll get back $200 per year just on groceries.

Paying utilities, insurance and other essential bills on a cash-back card can net a family hundreds of dollars a year, as long as the bill is being paid in full each month and interest is never accrued.

Benefit from points cards

While cash-back cards give one or two cents on the dollar, they probably won’t earn you as many returns as other credit cards can. For real returns, the “points” cards are king. Believe it or not, points cards can be so useful, an entire industry has popped up to guide people on how best to earn and redeem points.

Check out sites like The Points Guy, Mommy Points or Frugal Travel Guy, among others, to start learning how to maximize your returns on credit points. There are iPhone/Android apps dedicated to this as well.

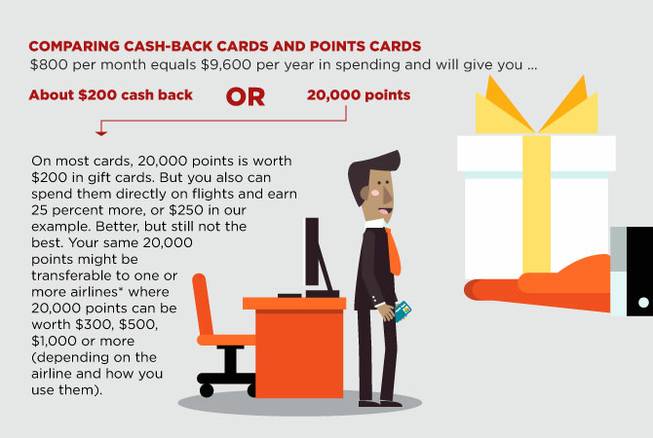

• $800 per month equals $9,600 per year in spending and will give you about $200 cash back or 20,000 points

On most cards, 20,000 points is worth $200 in gift cards. But you also can spend them directly on flights and earn 25 percent more, or $250 in our example. Better, but still not the best. Your same 20,000 points might be transferable to one or more airlines* where 20,000 points can be worth $300, $500, $1,000 or more (depending on the airline and how you use them).

Invest wisely

The third way to earn money using credit is through wise investment. The theory is you should only buy with credit what you can afford to buy with cash. But that advice doesn’t apply to all circumstances.

Let’s say you have $20,000 cash and you want to buy a car. Your credit qualifies you for a 0 percent teaser rate for five years. This puts your payment at $333 per month and eventually costs you $20,000.

But instead of paying cash for the car five years ago, you invested the $20,000 into an S&P tracking fund (SPY), which could make your $20,000 worth more than $38,000 in that same time period. Granted, if you do it that way, you’ll use $333 each month to pay your car payment, so your profit margin won’t be quite as massive as it might seem.

Even if your interest rate is 2, 3 or 4 percent, you may be better off investing your money than shelling out the cash (the annualized rate of return on the S&P is 13.75 percent for the past five years).

It’s a math problem, but it’s not that hard: When the bank wants to charge you less to use their money than you’re earning by investing it, you win by borrowing theirs.

The warning

None of this fancy math will ever earn you money if you’re paying credit card interest rates. It can also cost you a ton of heartache and headache if you’re overspending on your budget or making purchases on credit cards that you don’t have the cash to cover.

Earning cash using credit is not about putting off payments because you can’t make them or buying things you can’t afford right now. Even in our car example, if you lost your job, the money is there to pay cash for the car, so you don’t have to worry about that payment.

*Pro tip: To maximize returns, points cards are better than airline-specific miles cards, because they allow the points to be transferred to several airlines, allowing you to maximize your returns.

Nothing in this article is meant as investment advice.