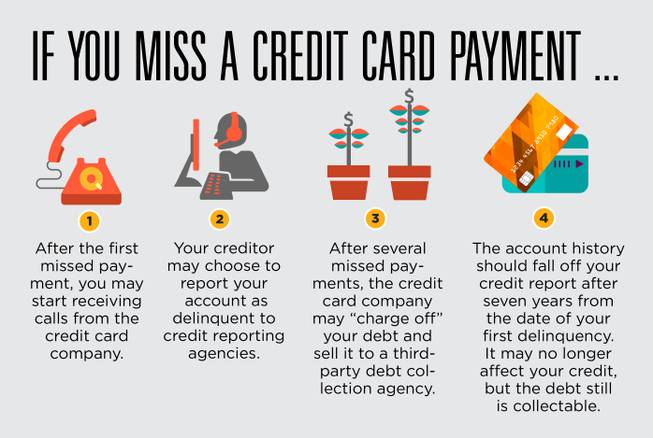

Failing to pay the minimum on your credit card bill, or failing to pay altogether, can have a slew of serious consequences, both in the long and short term. There are many actions that can be taken against you, and they can get progressively worse the longer you’re unable to pay.

Can a credit company come after me?

The Fair Debt Collection Practices Act prohibits third-party debt collection agencies from using abusive tactics and limits the amount of contact they can make with consumers. If you have an attorney, the collector should go through him or her, and no longer can contact you directly.

What should I do if I can’t pay?

If you’re unable to pay credit card debt, there usually are three options:

1. A debt consolidation loan

2. A bankruptcy filing

3. A debt settlement

The best course of action depends on the specifics of your debt, but a debt settlement often is considered the most desirable because it allows you to pay off your debt for less than what you owe without having to put a bankruptcy on your credit score. However, while a great option, debt settlements are complicated and can be difficult to negotiate without legal counsel.